YG Plus to Distribute Netflix Korea Original Soundtracks Globally and in 4-way bidding war for DREAMUS, Music Distributor for JYP Ent.

It was reported that YG PLUS, among other bidders, has responded to the sale process of Dreamus Company, sparking a rise in Dreamus stock prices. Earlier this week, YG PLUS also announced a global partnership with Netflix to distribute original soundtracks (OSTs) from Korean Netflix productions.

YG PLUS is currently the Top 2 music distributor in Korea.

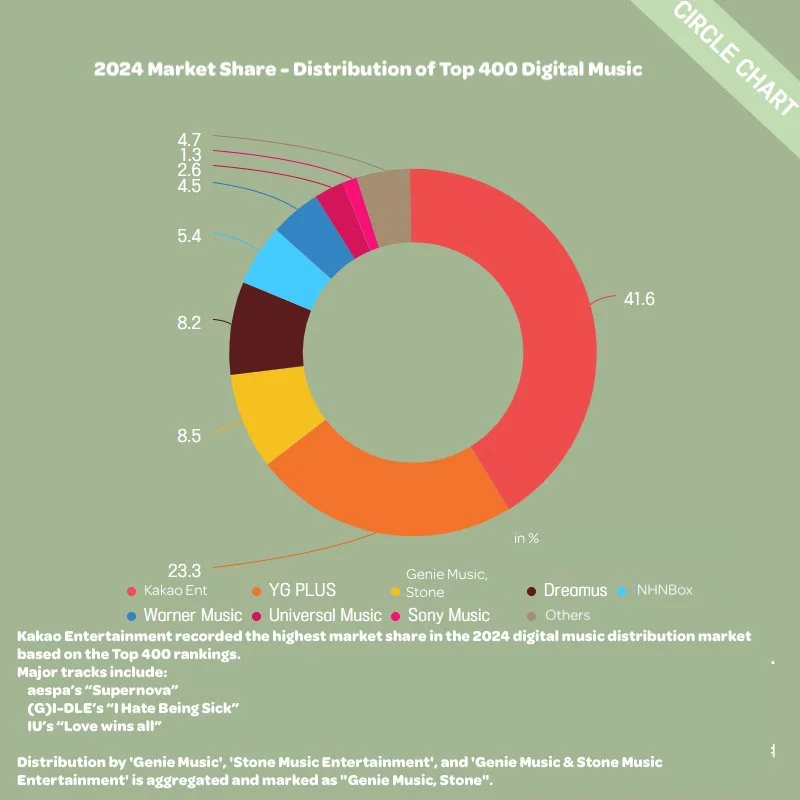

Kakao Entertainment recorded the highest market share of 41.6% in the 2024 digital music distribution market based on the Top 400 rankings. YG PLUS recorded 23.3% while DREAMUS recorded 8.2%

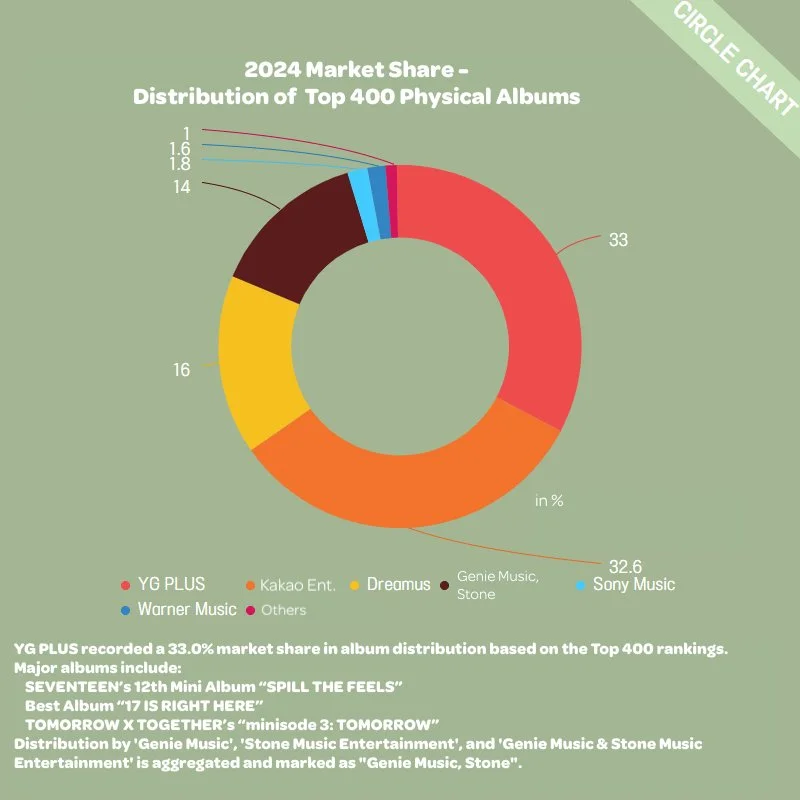

YG PLUS recorded the biggest market share at 33.0% in album distribution based on the Top 400 rankings. The biggest sellers are albums from HYBE Labels. Kakao Entertainment was a close 2nd with 32.6% and DREAMUS with 16%.

YG PLUS is currently in a 4-way bidding competition to acquire Dreamus Company, alongside Busan Equity Partners, Be My Friends, and the Daemyung GEC & JC Partners consortium.

YG PLUS is one of Korea’s top two music distributors (alongside Kakao Entertainment), while Dreamus is among the five largest. Dreamus previously distributed music for both JYP and SM Entertainment before Kakao Entertainment became SM’s major shareholder.

SK Square, which owns 38.67% of Dreamus, plans to accept binding offers after evaluating each bidder’s financial capability and sincerity. The decision will also hinge on whether bidders are willing to acquire the 23.49% equity held by the second-largest shareholder, Shinhan Venture Investment.

SK Square is expected to select a preferred bidder by the third week of July. To verify intent, Samil was appointed as the sales advisor. Some bidders may voluntarily withdraw during this process.

Dreamus currently has a market capitalization of approximately 140 billion KRW. If only SK Square’s stake is sold, the expected sale price with a 100% management premium would be around 100 billion KRW.

YG PLUS is considered the most closely watched candidate post-acquisition. As of Q1, it held 140 billion KRW in current assets and posted 180 billion KRW in annual revenue last year.

Busan Equity Partners has a prior M&A history with SK Square, having acquired “Good Service” from T Map Mobility in May and is reportedly in talks to acquire its airport limousine business. Be My Friends, co-led by former Dreamus CEO Lee Gi-young, has demonstrated the strongest and most persistent intent to acquire Dreamus.

Once qualified candidates are selected, the stock purchase agreement (SPA) is expected to be processed over a month.

Kim In-ho, Head of YG PLUS’s Music Business Division, stated:

“This partnership is a starting point for expanding the boundaries between Korean Netflix content and music, opening a new global music business model. By combining both companies’ strengths, we aim to deliver a more immersive experience to fans around the world.”YG PLUS has also signed a deal to handle the global distribution of OSTs from Korean Netflix series and films across 190+ countries, including joint promotional campaigns.

(Netflix has also worked with another YG subsidiary, The Black Label, for its animation KPop Demon Hunters, experiencing global success currently.)

The collaboration aims to combine both companies’ strengths in music distribution, marketing, and platform reach to expand K-content’s global presence and enhance user engagement. It marks a rare instance of a Korean company being directly entrusted with global OST distribution by Netflix.